Settling insurance claims after a disaster

In impacted counties, florida is in the process of setting up "insurance villages" at disaster recovery centers with upwards of 25 carriers, where people can go and file claims, state officials said. "they will start writing checks initially, that will be living expense money. This will be the dollars just to help people go

find

a place to live, sustenance dollars," jimmy patronis, florida's chief financial officer, said during a press briefing thursday. "then you'll be signed up where adjusters will come and inspect the damage.

".

Since 1985, merlin law group has aided policyholders achieve recovery with their property insurance claims. We have created an ebook detailing what merlin can bring to the table in terms of legal representation. Don’t let insurance companies lead you to a second disaster — allow merlin law group to help! download ebook.

How to Get Insurance to Pay for Water Damage

Act quickly: the sooner you report the damage to your insurance company, the sooner they can start the claims process. Document the damage: take photos and videos of the damage, as well as any damaged personal property. This will help the insurance company assess the extent of the damage.

Keep receipts and invoices: keep any receipts and invoices for any temporary repairs or cleaning services you have to pay for, as these may be covered by your insurance. Keep in touch with the insurance company: stay in touch with your insurance company throughout the claims process to

ensure

that everything is going smoothly.

Keep receipts and invoices: keep any receipts and invoices for any temporary repairs or cleaning services you have to pay for, as these may be covered by your insurance. Keep in touch with the insurance company: stay in touch with your insurance company throughout the claims process to

ensure

that everything is going smoothly.

Immediately report all losses to your insurance agent or company. Immediately report a loss to the police if your vehicle is stolen, vandalized, or damaged by a hit-and-run driver. Without a police report your company could deny your claim. In fact, under division of motor vehicle law you are required to report any accident involving property damage in excess of $500. 00 to the appropriate authorities. You must make the damaged vehicle available for inspection by the insurance company before you have it repaired. Protect your vehicle from further damage. If you don't do this, your insurer could refuse to pay for any subsequent damage.

Step 5: Determine if you need to leave the home.

Did you know that floods are the most frequent and costly disaster in kentucky, according to the kentucky energy and environment cabinet (keec)? anywhere it rains, it can flood. Flooding can affect anyone, even those outside of a high-risk zone, and sometimes rapidly rising water from heavy rains forces residents to leave their homes behind as they head for the safety of higher ground. If a flood has occurred in your area, there are several steps you can take to begin a safe and effective recovery of your home and possessions. Read on for helpful information regarding what to do when returning to a flooded property to assess the damage:.

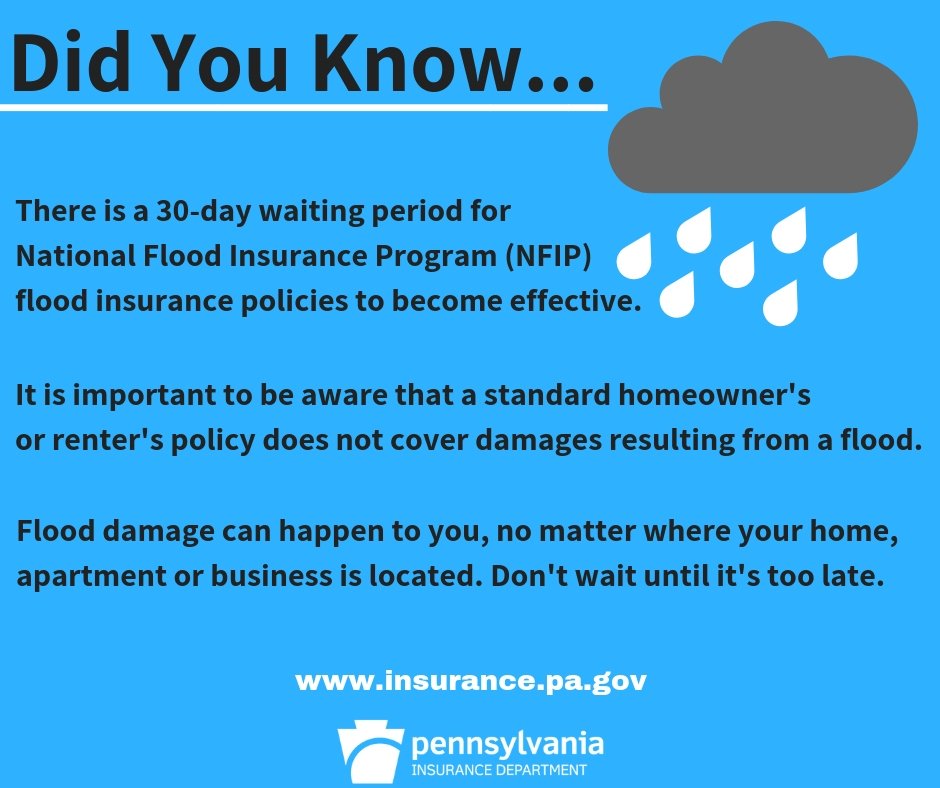

Making an insurance claim for flood damage

Don't attempt to drive through flooded roadways. Check for structural damage before re-entering your home or business. Flood-damaged buildings can collapse. Be cautious about gas leaks or energized wiring in flooded basements. If you have damage, call your insurer or agent. Take photos or video. Make a list of lost or damaged items. Even if you didn't have flood insurance, you may qualify for some federal emergency grants or loans. Talk to your insurer before making permanent repairs or disposing of damaged property. Save receipts from any mitigation efforts (sandbags, pumps, etc. ) for possible insurer reimbursement. If you have to move, make sure your insurer or agent has a way to reach you.

Starting a claim for flood damage

Waiting on insurance claims while your home is in disrepair is difficult for anybody. It’s only natural to want to start putting your home back together as soon as possible. Bu, did you know that any repairs you make to your home right after a hurricane could affect the outcome of your insurance claim? before starting any repairs, talk with your insurer. You might be able to make temporary fixes, like putting a tarp over the roof, but we recommend always checking with your insurer first to confirm it won’t affect your claim. They can help you determine what damages you can patch up now vs.

Comments

Post a Comment